Simple interest is a method of calculating interest on a principal amount over time. It is called “simple” because interest is calculated only on the original principal, not on accumulated interest. Simple interest grows linearly over time, unlike compound interest which grows exponentially. The formula for simple interest is: SI = P × R × T/100, where SI is Simple Interest, P is principal, R is annual interest rate, and T is time in years. It’s easier to calculate than compound interest, making it more straightforward for borrowers and lenders.

Important Terms Related to Simple Interest

Principal : The money borrowed from anyone is called Principal, It is denoted by ‘P’

Time: Money is borrowed for some specific time period that time period is called interest Time and it is denoted by ‘T’

Amount: The Principal becomes Amount when interest is added to it and that Amount is represented by ‘A’. The total amount after simple interest is calculated as: A = P + SI.

Interest: It is the amount to be paid on the principal or the amount received on the money lent.

Rate of Interest: Interest on Rs.100 in one year is called Rate of Interest

Simple Interest Formula

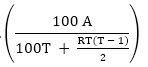

1. If a certain sum in T years at R% per annum amounts to Rs. A, then the sum will be

![]()

2. The annual payment that will discharge a debt of Rs. A due in T years at R% per annum is .

3. If a certain sum is invested in n types of investments in such a manner that equal amount is obtained on each investment where interest rates are R₁, R₂, R₃ ……, R_n, respectively and time periods are T₁, T₂, T₃, ……, T_n, respectively, then the ratio in which the amounts are invested is

![]()

4. If a certain sum of money becomes n times itself in T years at simple interest, then the rate of interest per annum is

![]()

5. If a certain sum of money becomes n times itself at R% per annum simple interest in T years, then

![]()

6. If a certain sum of money becomes n times itself in T years at simple interest, then the time T in which it will become m times itself is given by

![]()

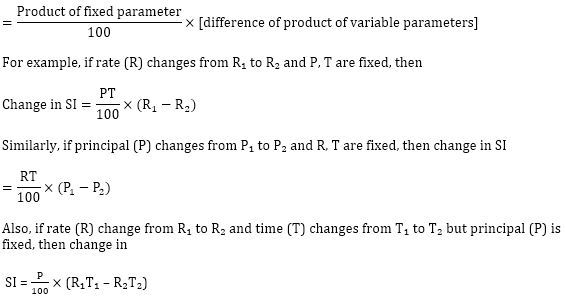

7. Effect of change of P, R, and T on simple interest is given by the following formula:

8. If a certain sum of money P lent out at SI amounts to A₁ in T₁ years and to A₂ in T₂ years, then

![]()

9. If a certain sum of money P lent out for a certain time T amounts to A₁ at R₁ % per annum and to A₂ at R₂ % per annum, then

![]()

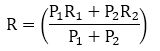

10. If an amount P₁ is lent at the simple interest rate of R₁ % per annum and another amount P₂ at the simple interest rate of R₂ % per annum, then the rate of interest for the whole sum is

SSC CGL Previous Year Question Papers, D...

SSC CGL Previous Year Question Papers, D...

SSC CGL Notification 2025: Form Correct...

SSC CGL Notification 2025: Form Correct...

SSC CGL Cut Off 2025, Check Post- Wise C...

SSC CGL Cut Off 2025, Check Post- Wise C...