Table of Contents

MSME Full Form & Definition

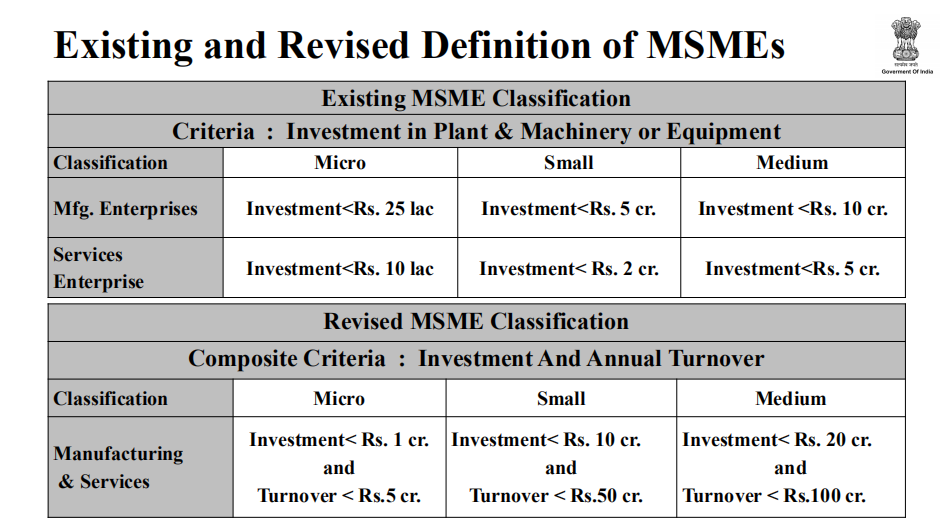

MSME stands for Micro, Small, Medium enterprises. The definition of MSMEs has been revised by the Ministry. Earlier, the benefits were limited to companies with less turnover or investment. With the fear of losing the entitled benefits, many MSMEs fear to outgrow the size of what has been defined as MSME. Hence, the new definition came into force that provided benefits to companies with a turnover of Rs 100 crore as well. The move will expand the capabilities and companies can expand their businesses with the support of the government.

MSME Types

As per the new definition, MSMEs has been divided into 3 categories based on revised guidelines.

- Micro-enterprises will be the companies with an investment of up to Rs 1 crore and a turnover of up to Rs 5 crores.

- The small enterprises will be the companies with an investment of up to Rs 10 crore and a turnover up to Rs 50 crore.

- Further, the medium enterprises will be the companies with an investment of up to Rs 20 crore and turnover up to Rs 100 crore.

Who is eligible for MSME?

Micro, Small & Medium Enterprises (MSME) registration can be done by any of the following business entity:

- Proprietorships,

- Partnership Firm,

- Private Limited Company

- Public Limited Company,

- Limited Liability Partnership,

- Hindu Undivided Family,

- Self Help Groups

- Society / Co-Operative Society

- Trust

MSME Loan

MSME loans are given to Micro, Small and Medium Enterprises (MSMEs) by financial institutions such as banks and NBFCs. MSME loans are also granted by the government with the help of several schemes. Government Schemes that come under MSME loans include CGTMSE, Mudra Loan, PMEGP, etc. These schemes assure that the new and existing entrepreneurs in the country get the required financial aid and funding for their businesses.

MSME registration

The MSME registration can be done on the official website by entering the Aadhaar number and filling up the application form. Any entrepreneur having valid Aadhaar Number can apply for MSME Registration Online.

MSME Certificate: How to get certificate online?

To get the MSME certificate online, you must follow some basic steps. Candidates are required to fill up the application process and make payment. Check out the steps given below:

1. Fill up the application form

2. Make online payment

3. The executive will process the application

4. Receive the certificate on mail

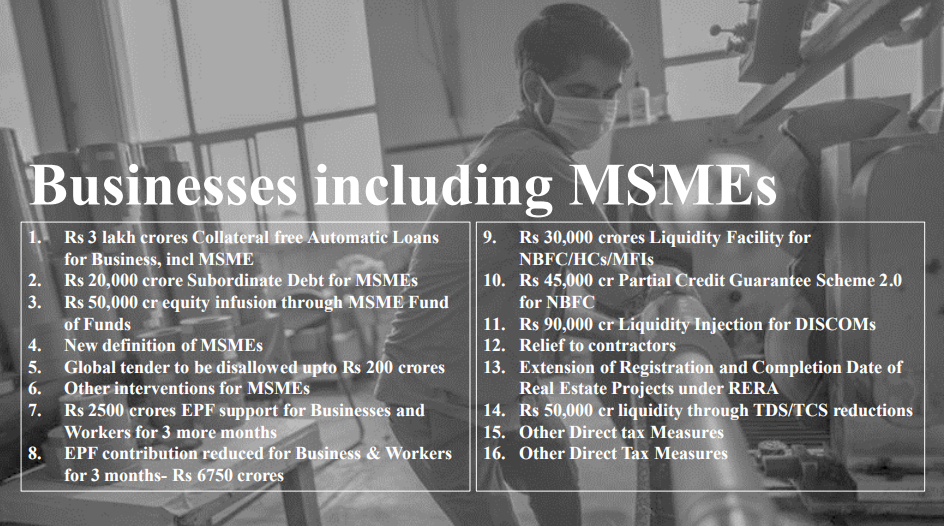

Rs 3 lakh crores Collateral-free Automatic Loans for Businesses, including MSMEs

Businesses/MSMEs have been badly hit due to COVID-19 and need additional funding to meet operational liabilities built up, buy raw material and restart businesses.

- Emergency Credit Line to Businesses/MSMEs from Banks and NBFCs up to 20% of entire outstanding credit as on 29.2.2020

- Borrowers with up to Rs. 25 crore outstanding and Rs. 100 crore turnover eligible

- Loans to have 4 year tenor with a moratorium of 12 months on Principal repayment

- Interest to be capped

- 100% credit guarantee cover to Banks and NBFCs on principal and interest

- Scheme can be availed till 31st Oct 2020

- No guarantee fee, no fresh collateral

- 45 lakh units can resume business activity and safeguard jobs.

Rs 20,000 crores Subordinate Debt for Stressed MSMEs

- Stressed MSMEs need equity support

- GoI will facilitate the provision of Rs. 20,000 cr as subordinate debt

- Two lakh MSMEs are likely to benefit

- Functioning MSMEs which are NPA or are stressed will be eligible

- Govt. will provide a support of Rs. 4,000 Cr. to CGTMSE

- CGTMSE will provide partial Credit Guarantee support to Banks

- Promoters of the MSME will be given debt by banks, which will then be infused by the promoter as equity in the Unit.

Rs 50,000 cr. Equity infusion for MSMEs through Fund of Funds

- MSMEs face severe shortage of Equity.

- Fund of Funds with Corpus of Rs 10,000 crores will be set up.

- Will provide equity funding for MSMEs with growth potential and viability.

- FoF will be operated through a Mother Fund and few daughter funds

- Fund structure will help leverage Rs 50,000 cr of funds at daughter funds level

- Will help to expand MSME size as well as capacity.

- Will encourage MSMEs to get listed on main board of Stock Exchanges.

Upcoming Government Exams, Complete Govt...

Upcoming Government Exams, Complete Govt...

Govt Jobs 2025, Latest Upcoming Governme...

Govt Jobs 2025, Latest Upcoming Governme...

RRB JE 2024 Notification, Exam Date Out ...

RRB JE 2024 Notification, Exam Date Out ...